The first thing I would say is don’t be put-off by the word “loan”, this can be forgivable loan aka free money when you qualify. Secondly, it takes only about 15 minutes when you have all your information ready to begin. There are several benefits offered through the CARES Act signed into law, and this can be confusing to start with and then mixed with what is real and what may be a scam, so be careful, visit the .gov websites. You can apply for a 7(a) loan with certain types of forgivable expenditures, unemployment benefits or you can start with the EIDL to receive some money without any banks involved.

The first thing I would say is don’t be put-off by the word “loan”, this can be forgivable loan aka free money when you qualify. Secondly, it takes only about 15 minutes when you have all your information ready to begin. There are several benefits offered through the CARES Act signed into law, and this can be confusing to start with and then mixed with what is real and what may be a scam, so be careful, visit the .gov websites. You can apply for a 7(a) loan with certain types of forgivable expenditures, unemployment benefits or you can start with the EIDL to receive some money without any banks involved.

For this post, my objective is to share the Economic Injury Disaster Loan (EIDL) information to our clients and any small local businesses at Avalon Park. It is one valuable relief for any Ma and Pa shops, Medical Practices or even Rental Property owners. If you are an individual looking for Stimulus check, and did not file taxes, you can skip this and on April 10, 2020 goto www.irs.gov/coronavirus/non-filers-enter-payment-info-here

EIDL loan; the first $10,000.00 will be a “grant” (free money) from the government if used for the following:

• Providing paid sick leave (not applicable if your office is closed)

• Maintaining payroll (not applicable if office is closed)

• Making rent or mortgage payments (yes, applicable if you pay rent or if you have a loan on your building, a practice purchase or equipment loan)

• Repaying obligations that cannot be met due to revenue loss

For a start I would suggest borrowing $10,000.00 on this loan; this is free money. Any additional amount you borrow is a formal loan that you will have to pay back, so only do it if you actually need more.

What To Gather For The Application

Get your 2019 Profit and Loss (P&L) Statement and January 2020 estimates on hand. You will need to know your:

- EIN

- Gross revenue

- Cost of goods sold

- Operation expenses

- Date business established

- Current ownership since

- All owner’s personal information such as SS# Email Phone and birth-date.

- Bank account / routing number for direct deposit within 3 days of approval

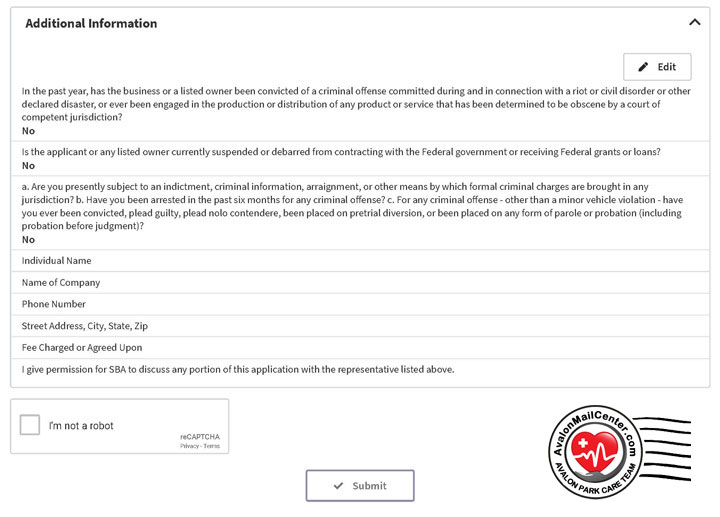

At the end of the application, you will review a summary of your entries and can edit to make changes. Submit your application online and you are done. No stamps required.. just free love from us!

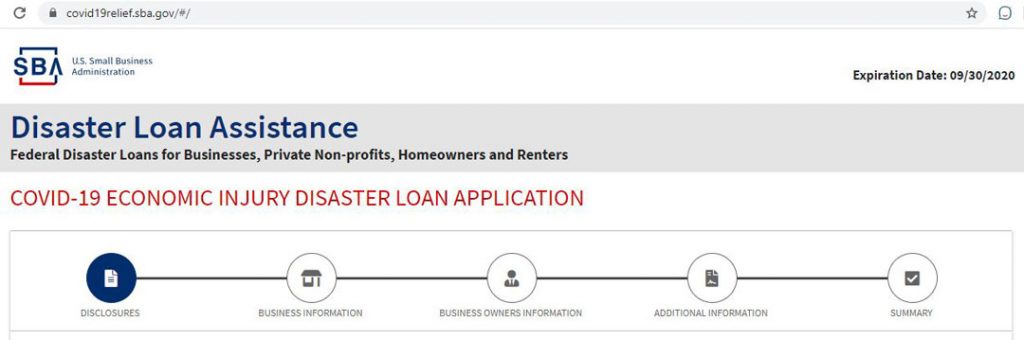

How to apply

- Copy and goto this website https://covid19relief.sba.gov/ or https://www.sba.gov/funding-programs/disaster-assistance

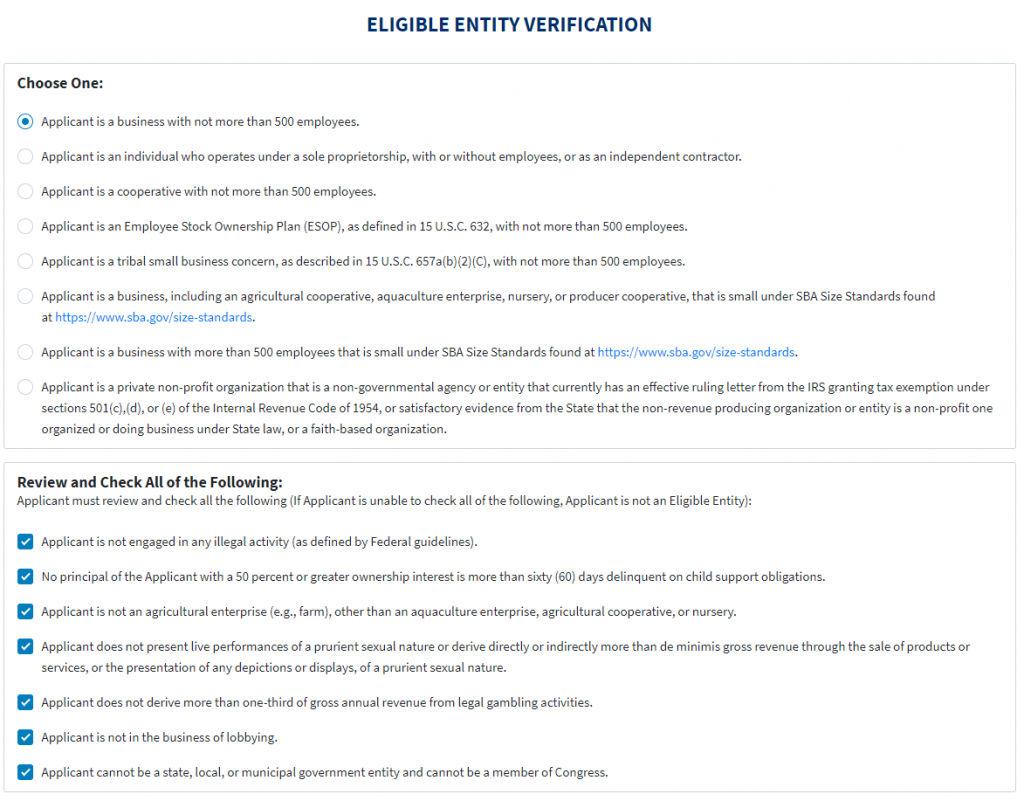

- Select “Applicant is a business with not more than 500 employees”

- Review each question and check the boxes as it relates to you.

- Enter your business information (Legal Name, Trade Name, EIN)

- Select Your business type

- Enter your Gross Revenues 12 months before January 31st:

See your P&L Statement - Input Cost of Goods Sold:

See your P&L Statement - Rental Properties: Lost Rents due to the Disaster:

– This amount should be “$0” unless you are a landlord renting and losing rentals - Input Business Address and other information

- Business Activity: Select what is appropriate

- Detailed Business Activity: Select what is appropriate

- At the top of the Business Owner’s Information section, select “no” next to “Is your business owned by a business Entity?” (if you are not ).

– If you are a single-owner, fill out your personal information as owner

– If you are a partnership, “Add Additional Owner” at the bottom of the screen, fill out the other owner’s information and percentage of ownership. - Answer the questions on the final page, and be sure to check the box “I would like to be considered for an advance of up to $10,000”

- Put your Bank information where money will be deposited, review summary of information, and submit. You are done.

Hope this is helpful to you, stay safe and say hello when you are around. Opening Hours are the same, we will continue to support the community as long as we can. Check back, some Sanitizers shipment will arrive in a week.

| PPP LOAN | EIDL LOAN | |

|---|---|---|

| Loan Administrator | SBA approved lenders | SBA |

| Max Amount | Lesser of $10 million or 2.5 times average monthly payroll | Up to $2 million |

| Term | 2 years | Up to 30 years |

| Interest Rate | 1% | 3.75% |

| Deferral | 6 months (interest accrues) | 1 year (interest accrues) |

| Prepay Allowed? | Yes | Yes |

| Can Be Used For | Payroll, benefits, mortgage interest, rent, utilities, other debt | Payroll, benefits, accounts payable, other expenses |

| Refinance Debt? | Yes for EIDL | No |

| Collateral Required? | No | For loans over $25,000 |

| Forgiveness | Yes, if 75% payroll | Yes, for $10,000 advance |

| Guarantee Required? | None | No for loans under |

Avalon Mail Center Team 3564 Avalon Park E Blvd, Suite 1 More about Consulting here...